In the case study that follows, Grasshopper Bank shows what a truly digital-first, innovation-driven bank looks like-and the numbers are impressive.

Built from the ground up for speed, automation, and secure remote collaboration, Grasshopper is proving that modern banking doesn’t need massive IT teams or physical branches to scale.

A Bank Operating at Startup Speed

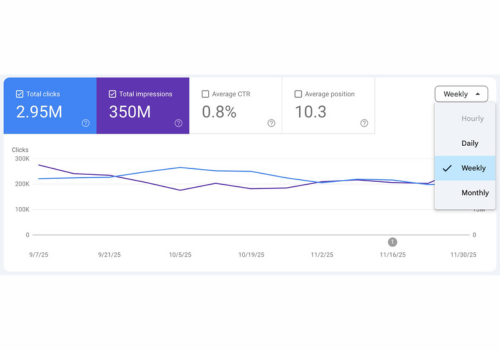

Grasshopper shared some measurable outcomes of its productivity transformation:

- Saved over 2,000+ hours per month with AI-powered workflows

- 155 fully remote employees operating smoothly across locations

- Only a 3-person IT team to support the entire digital bank

This efficiency hasn’t come at the expense of security: the bank maintains enterprise-grade protection and compliance while running lean.

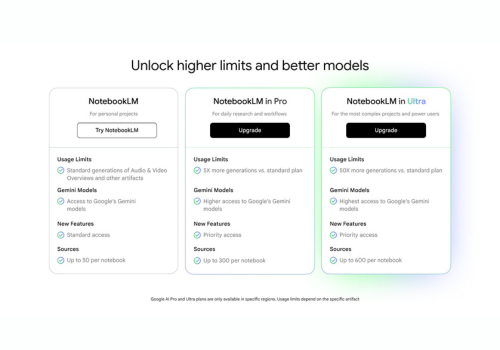

The Power Behind Grasshopper’s Scale: Google Workspace w/ Gemini

Grasshopper leverages Google Workspace integrated with Gemini, Google’s AI assistant, to supercharge daily operations.

Gemini lets teams:

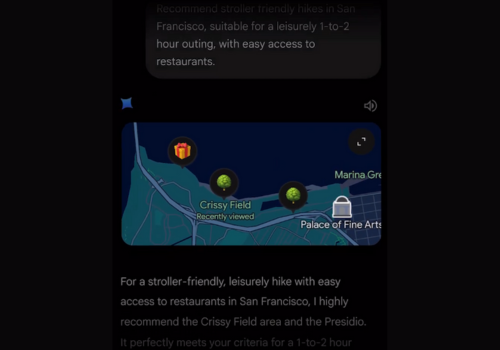

- Automate creation and analysis of documents

- Draft client communications instantly

- Summarize complex financial data

- Amplify employee productivity across Gmail, Docs, Sheets, and more

- Reduce manual workloads that traditionally slow banks down.

The result? A banking staff that moves faster, collaborates smarter, and works with far fewer bottlenecks.

A blueprint for the next generation of banks.

Grasshopper Bank stands as a model for what the future of banking will look like.

✔ AI-powered operations

✔ Minimal overhead

✔ Fully remote workforce

✔ Enterprise-grade compliance

Rapid scaling without added complexity As more financial institutions look to modernize, Grasshopper’s journey serves to illustrate how AI and the cloud can redefine efficiency across the industry.